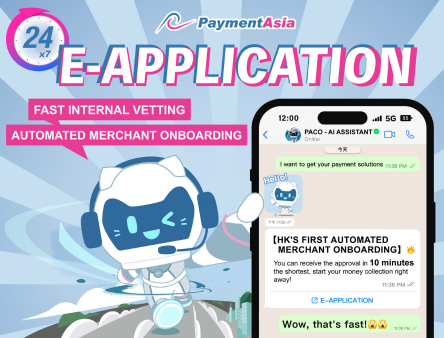

[Hong Kong, July 10] – Payment Asia, a leading payment solutions provider, has announced the launch of the first AI-powered comprehensive processing service, which includes automated merchant onboarding and assignment of merchant accounts, AI customer service, and an auto accounting system. This marks the first time such a comprehensive suite of automated services has been made available in Hong Kong together with AI development, taking merchants’ sales to the next level.

With the introduction of these new services, Payment Asia is set to raise ESG standards for payment solutions in Hong Kong. The AI customer service and big data will provide clients with a seamless and personalized experience while helping to streamline the entire onboarding process, including non-face-to-face client identification and internal vetting methodology for new customers. Internally, the company put an end to the paper submission of expense claims and accounting, using AI for automatic approval and generating reports to all relevant departments for daily monitoring, driving ESG and sustainability in financial services.

“We are thrilled to be the first in Hong Kong to offer such a comprehensive suite of automated payment services,” said Paul Tang, COO of Payment Asia. “The use of AI can help multiply the efficiency of fintech companies. Our goal is to provide our customers with the best all-in-one experience. Adapting AI in our daily operation helps us to boost efficiency and turn our intentions for ESG into a workable reality.”

The fully automated merchant onboarding process is the area where Payment Asia is leading the way. By using AI and machine learning algorithms, Payment Asia can analyze customer data and verify their identities in real-time, without bureaucratic delay and complex email correspondence. This can help merchants streamline shorten their onboarding time and reduce the risk of fraud. With the increasing importance of data privacy and security, e-KYC processes are becoming more critical than ever, and Payment Asia can help businesses meet these challenges without compromising any security risk.

Payment Asia is also using ChatGPT, an AI natural language model, to embed in daily customer service, as a powerful tool to provide comprehensive answers in any field. By analyzing customer inquiries and providing relevant responses, ChatGPT can help businesses improve their customer satisfaction and retention rates. With the increasing demand for online customer service, more AI tools are poised to become essential for companies looking to stay ahead of the competition.

In addition, Payment Asia automates its accounting process with a cloud-enabled platform, as an imperative act to embrace ESG in financial services. By issuing corporate cards to all staff, the company also uses AI to analyze transaction data and categorize expenses. The auto approval expense platform also generates reports for every department to track their spending, while giving guidance for cost management. AI plays a critical role in promoting sustainability, as the company reduces environmental impact, improves efficiency, and minimizes paper usage.

Payment Asia would like to raise the standard for payment solutions in Hong Kong and digitize the whole business model while providing an efficient and environmentally-friendly solution. With its commitment to customer satisfaction, Payment Asia hopes to bring more services and tech innovation for years to come.

About Payment Asia

Established in 1999, Payment Asia has been committed to providing innovative online payment technology, and electronic payment solutions for SME enterprises and even multinational companies in Asia. Payment Asia prepares simple and time-saving online payment systems for customers, covering credit cards, debit cards, UnionPay and e-wallets, and tailor-made omnichannel payment solutions for enterprises. In the past 10 years, we have actively innovated and added elements such as digital marketing, e-commerce solutions, and consulting to our business to meet the needs of merchants. Payment Asia has developed rapidly and has served more than 10,000 local and overseas merchants.

< Next post - Payment Asia COO Paul Tang Joins MSOA Board of Directors Prev post - Digital CX Awards 2023 | Best Payments Solution By A Vendor >